A report by RedStone highlights how Solana is becoming the backbone of the blockchain infrastructure for capital markets.

Summary

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- Network performance is a key driver of Solana’s growing dominance in the sector

- BlackRock, Apollo Global, Janus Henderson, and VanEck are among the big-name adopters

Solana (SOL) is emerging as the blockchain backbone of capital markets, capturing a major share of real-world asset tokenization. On Monday, September 29, blockchain oracle network RedStone published a report detailing Solana’s increasing dominance in RWAs.

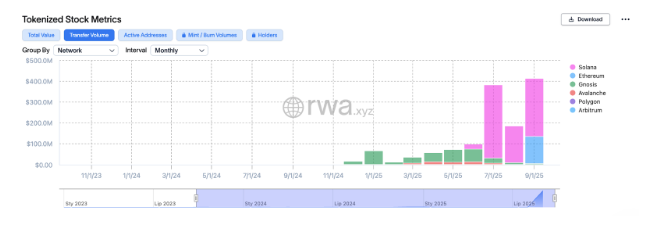

According to the report, Solana hosts $700 million in RWA assets, and over $13.5 billion if including stablecoins. The RWA figure grew by more than 500% year over year, making Solana one of the largest networks for tokenized assets.

For instance, following the xStocks integration with the network, Solana (SOL) trading volumes for tokenized equities quickly surpassed those for Ethereum. This acceleration benefited from partnerships with exchanges such as Kraken, which aim to enable fast and low-cost transfers for their users.

Solana dominates through performance

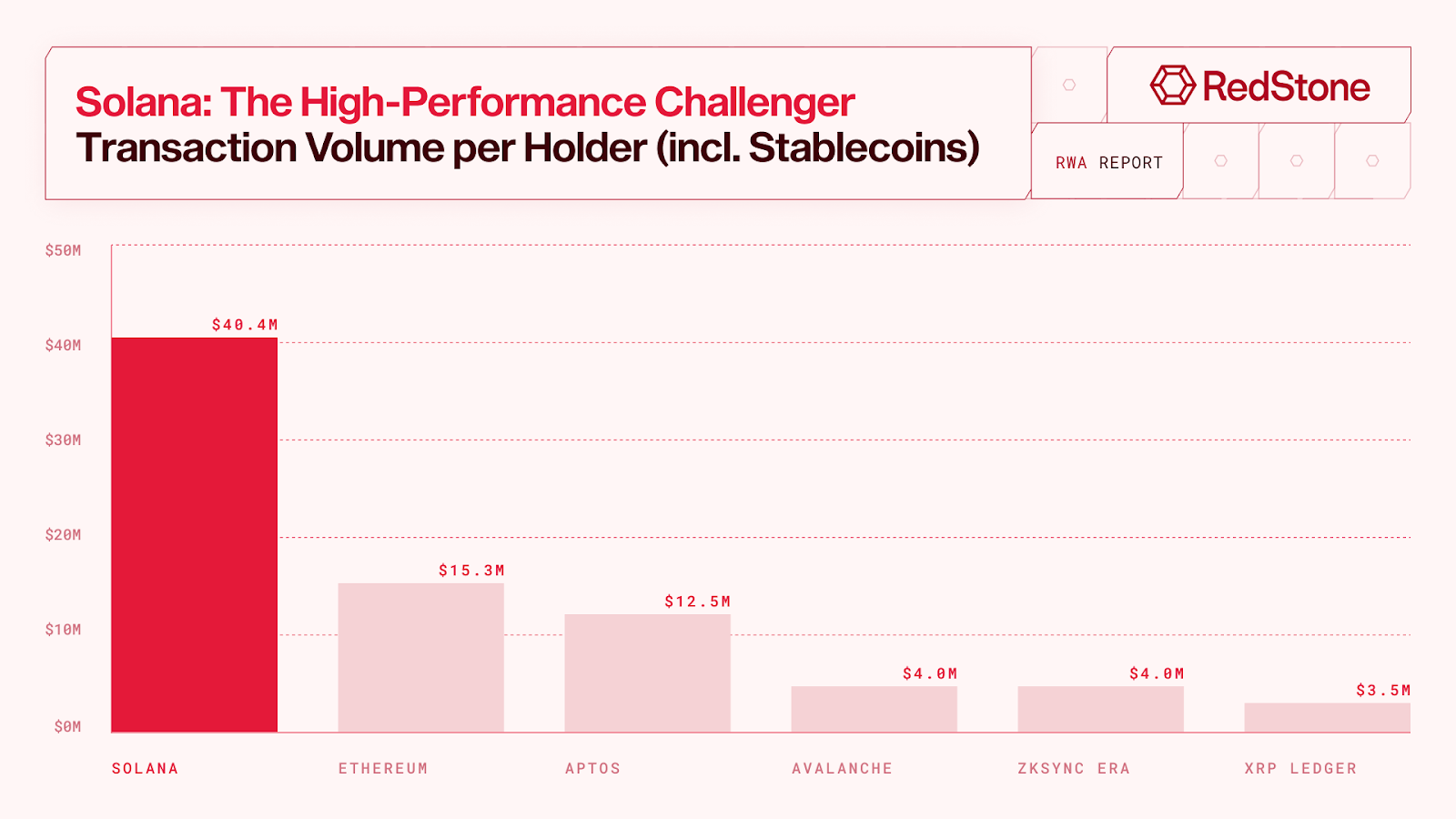

RedStone’s report highlights Solana’s performance as one of the main reasons for its dominance in asset tokenization. According to the report, institutional investors rely on high throughput for their RWA applications. Solana, which boasts a capacity to handle up to 100,000 TPS, is a natural choice for many.

“For RWAs, there are really only 2 places: It’s either Ethereum or Solana,” said Robert Leshner, CEO of the tokenization platforms Superstate.

This performance has attracted big names to the network, including BlackRock, Apollo Global, Janus Henderson, and VanEck. Moreover, Solana also hosts popular applications like Phantom, Raydium, Jupiter, and Pump.fun, demonstrating its appeal among retail users.