Ripple’s stablecoin, RLUSD, recently saw its market cap surpass $1 billion for the first time in history. The stablecoin is currently the 11th largest stablecoin in the world.

Summary

- Ripple’s RLUSD stablecoin has surpassed the $1 billion market cap milestone within a year of its launch, marking a significant achievement that places it among the top USD-backed stablecoins.

- The surge in RLUSD’s growth is driven by expanding retail adoption, strong Ethereum network circulation, and recent institutional integrations.

Ripple’s stablecoin saw its market cap surge to $1.025 billion. This marks the first time in history the stablecoin saw its value surpass the $1 billion threshold. Within less than a year after it was launched, the stablecoin was able to reach more than $1 billion in market value.

According to data from DeFi Llama, Ripple USD (RLUSD) is currently the 11th largest stablecoin market cap, trailing behind stablecoin firms like Ethena (USDE), Falcon, Blackrock and PayPal (PYUSD). However, other crypto analytics platforms like CoinMarketCap place RLUSD in the top 10 amongst USD-backed stablecoins.

Though this milestone significantly puts the Ripple-issued stablecoin among top contenders, it still has a long way to go if it wishes to catch up to the stablecoin giants in the top ranks. Tether (USDT) continues to hold its place as the largest stablecoin by market cap with $183 billion, which represents nearly 60% of the total stablecoin market cap.

In second place, is Circle’s USD Coin (USDC) which has generated a market cap of $74.6 billion. Ethena’s USDe stands in third place with a market value of $9.06 billion.

Although the stablecoin industry has been gaining massive traction from a rise in institutional adoption, as more banks and other financial institutions start to gravitate towards stablecoins, its market cap has been on a gradual descent.

The total stablecoin market cap has lost about $2.47 billion within the past seven days. Though this loss equates to only 0.80% of the total market cap, it is still an indicator that the market may be waning.

Despite the drop, RLUSD appears to be soldiering through it. As of Nov. 5, Ripple USD’s trading volume has risen by 82.5% compared to the previous day of trading, rising to $276 million. Not only that, the surge in market cap could also be attributed to its integration with ecosystems and institutional partners.

What is fueling RLUSD’s growth?

Upon its launch, RLUSD was initially marketed as a stablecoin meant for institutional use. However, the stablecoin has since garnered noticeable traction among retail users thanks to integrations with platforms like Transak and its rising presence in self-custodial wallets such as Xaman.

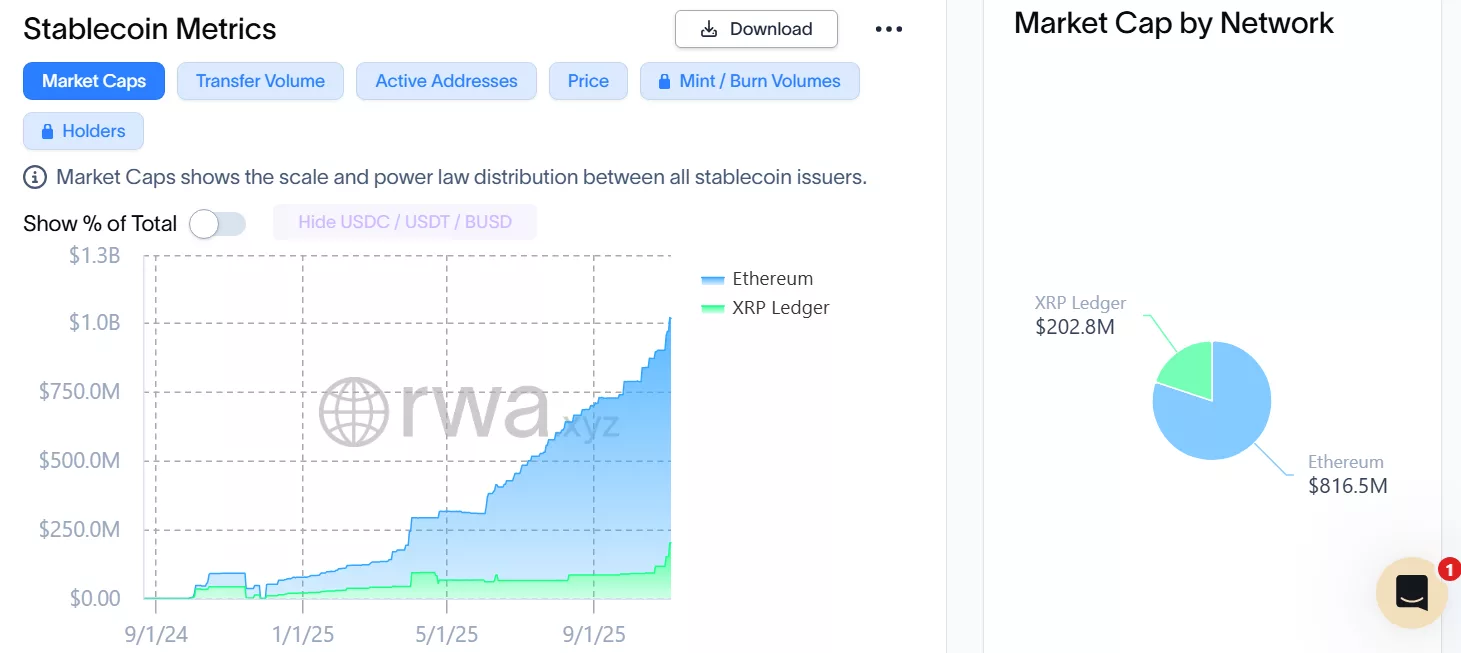

Data from RWA.xyz shows that the stablecoin’s market cap has gone up nearly 30% compared to the previous month. The number of RLUSD holders also saw an increase of 3.09% from last month, reaching as much as 38,201 addresses as of November 2025 with 4,741 active addresses on a monthly basis.

The majority of its market cap share comes from its circulation on the Ethereum (ETH) network, which represents about 80% of the total supply or equal to $816.5 million, while the XRP (XRP) Ledger version accounts for roughly 20% or around $202.8 million on-chain.

Most recently, Chicago-based derivatives exchange Bitnomial announced that it will be extending support for Ripple USD, accepting the asset for margin collateral and margin deposits. With the announcement, the platform becomes the first regulated exchange in the U.S. to accept stablecoins for margin collateral. Bitnomial is regulated by the Commodity Futures Trading Commission.