Just when creditors thought closure was within reach, Mt. Gox has pushed the repayment deadline again.

Summary

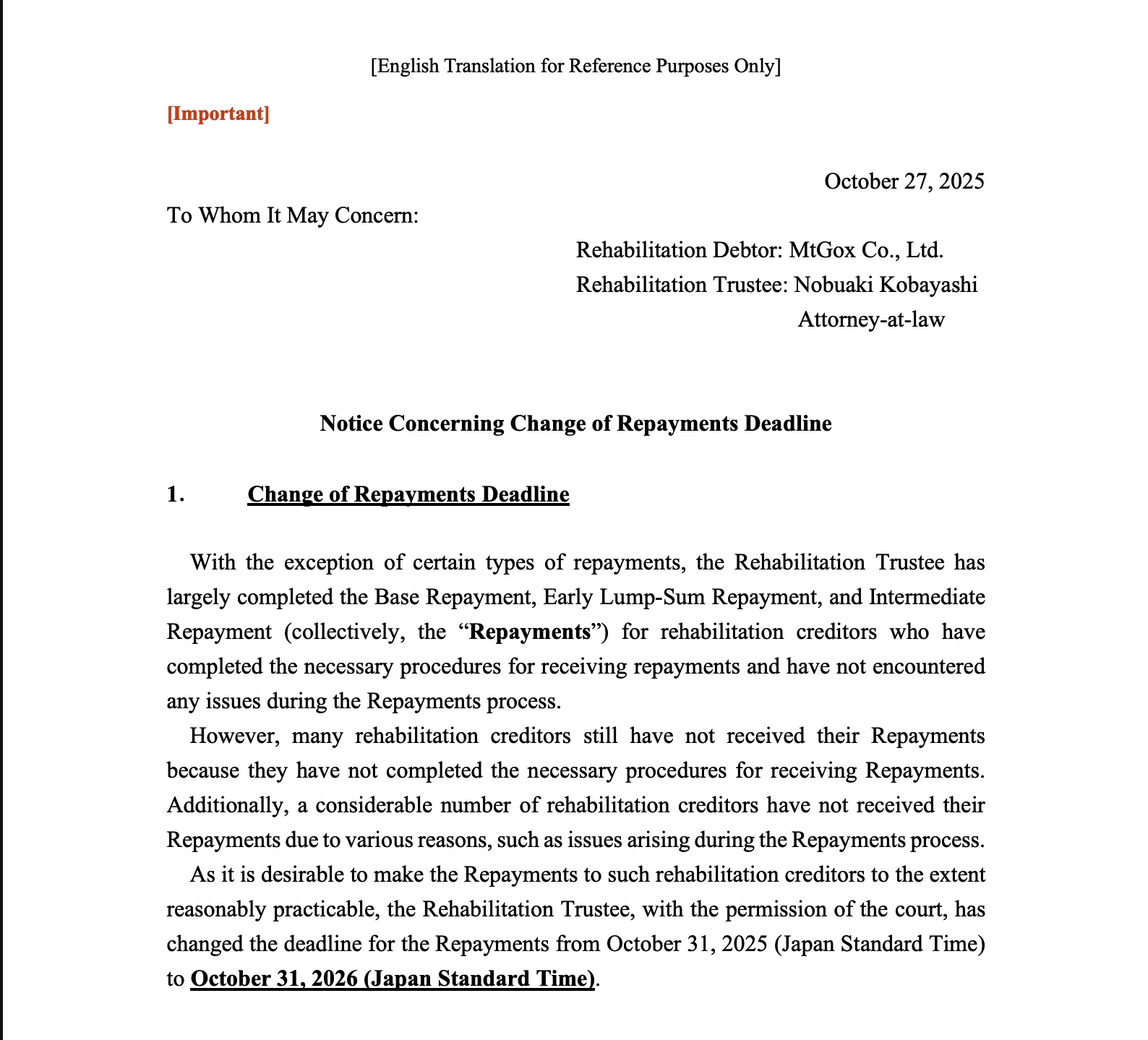

- Mt. Gox has officially extended its creditor repayment deadline to Oct 31, 2026.

- The extension was approved by a Japanese court, with the trustee citing the need to repay creditors “to the extent reasonably practicable.”

- According to the rehabilitation trustee, repayments have been completed for many creditors who fulfilled the necessary steps.

- This marks the third delay since the original deadline set for October 2023.

Mt. Gox, once the world’s largest Bitcoin exchange, has extended its creditor repayment deadline by another year, pushing it from Oct 31, 2025, to Oct 31, 2026. The announcement, made by the Rehabilitation Trustee on Oct 27, comes just days before the original deadline and marks the third delay in the long-standing compensation process.

The latest extension, approved by a Japanese court, is aimed at ensuring that more creditors, especially those who have not completed the necessary steps or encountered issues during the process receive their due repayments.

The statement explained that while the base, early lump-sum, and intermediate repayments have been largely completed for compliant creditors, “a considerable number” remain unpaid due to procedural lapses or technical issues.

So far, repayments have been successfully processed for about 19,500 creditors who met the conditions and encountered no complications. However, others are yet to receive their funds.

What happened to Mt. Gox?

Mt. Gox was founded in 2010 in Tokyo and grew to become the dominant exchange for Bitcoin trading. However, in 2014, the platform filed for bankruptcy after losing 850,000 BTC, worth nearly $500 million at the time, in what was later revealed to be a prolonged hacking operation. The collapse froze investor funds and sparked one of the longest and most publicized legal sagas in crypto history.

Creditors waited nearly ten years before receiving their first repayments in Dec 2023. As of Oct 2025, Mt. Gox holds roughly 34,680 BTC, valued at around $4 billion. Earlier this year, blockchain activity revealed major BTC movements from Mt. Gox wallets, fueling speculation that broader repayments were imminent which later occurred in July.

The latest deadline extension aims to give remaining creditors additional time to complete necessary procedures, and for the trustee to resolve all outstanding issues. Still, the crypto community remains watchful. Each development in the Mt. Gox case continues to cast a long shadow over Bitcoin markets, with fears of large-scale selloffs lingering in the crypto market.