Solana price is regaining momentum as renewed buying interest and steady institutional activity lift sentiment across the network.

Summary

- Solana has reclaimed the key $200 level amid renewed buying interest and profit-taking, with prices climbing over 5% in the last 24 hours.

- Institutional inflows, including growing assets in the REX-Osprey Solana + Staking ETF and Fidelity’s new support, have helped sustain momentum.

- Technical indicators like RSI and MACD suggest improving strength, though holding $200 as support remains key for continuation toward higher targets.

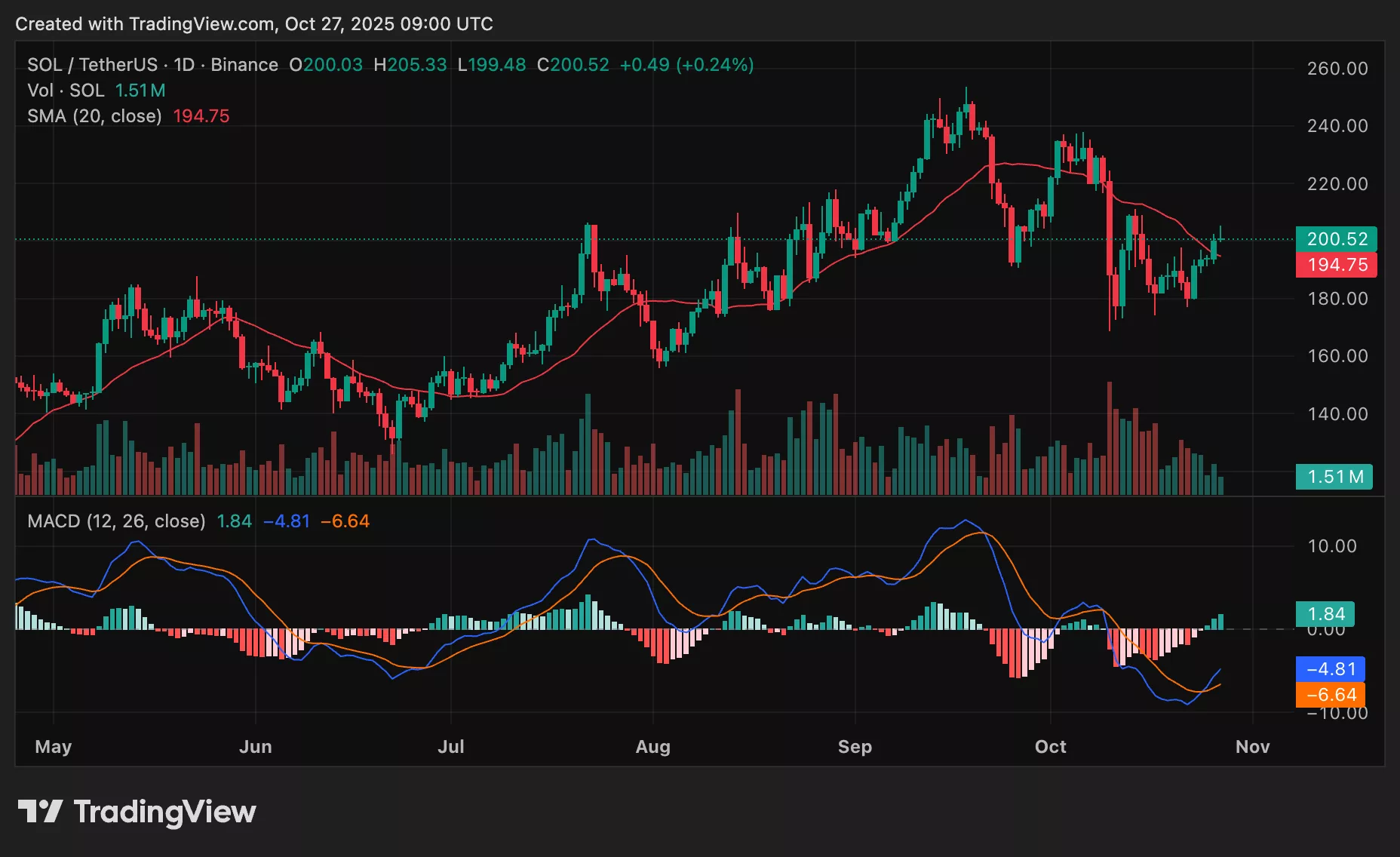

Solana pushed back through the $200 zone today as buyers returned, even as some traders booked profits into strength. The level has been a frequent battleground this month, with prior breakouts above $220 and pullbacks reinforcing $200 as the key pivot for momentum.

At press time, SOL (SOL) is trading around $204, up over 5% in the last 24 hours and over the past week, per market data from crypto.news. The token has climbed more than 10% across the last four trading sessions from the previous week’s low of $177.

Fresh institutional signals are helping the move. Steady inflows into the REX‑Osprey Solana + Staking ETF, which now manages over $400 million, and new Fidelity custody and trading support are adding credibility to SOL. Still, softer on‑chain readings and a recent bearish crossover have kept profit‑taking elevated near intraday highs.

Meanwhile, SOL’s fundamentals continue to evolve, with record stablecoin growth and network upgrades like Alpenglow serving as medium‑term tailwinds. These elements frame today’s breakout as part of a larger tug‑of‑war between new institutional demand and near‑term profit‑taking.

Solana price outlook

Solana printed a higher low cluster after reclaiming the $200 handle. Intraday ranges show a high near $205 and a low around $199, with increasing volume as momentum improves week to date.

For upside continuation, bulls want to hold $200 as new support and clear the immediate $205 shelf to open a run into the $210–$215 pivot zone, where the next decision area sits. A daily close above that pivot would put $230–$235 on the radar as the next logical target band if momentum and volume expand.

On the downside, a rejection from $205 followed by a loss of the 20‑day EMA near $197 would weaken the structure and expose a retest of $190, with a deeper fade eyeing the pivot around $182 if risk conditions deteriorate.

Oscillators are not overbought, but a rollover in RSI back below 50 and a MACD cross back to negative would refute Solana price bullish setup and argue for consolidation before any fresh attempt higher.