The Aster token is back in the spotlight, posting fresh gains on the day as it dethrones rival Hyperliquid in daily fees.

Summary

- Aster token price climbs double-digits on the day, trading at $1.94.

- Bulls eye breakout above $2.00 resistance, with key support at $1.90 and $1.85.

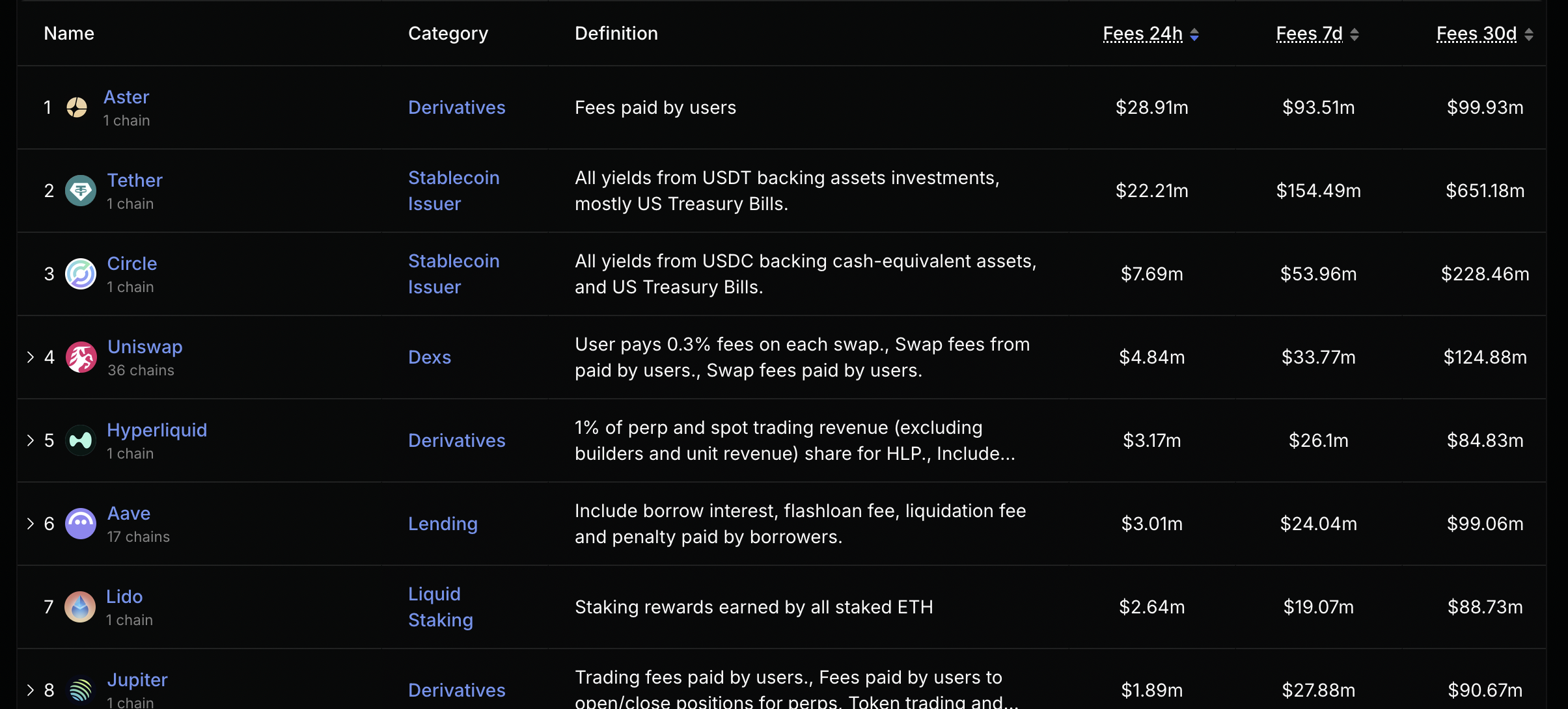

- Aster leads all protocols in daily fee generation, hitting roughly $29.2 million, surpassing Hyperliquid, Circle, and Tether.

The Aster token has started the week on a bullish note, rising 14% on Monday, September 29. It currently trades at $1.95 at press time, per data from crypto.news. The rally is also reflected in the weekly performance, with the token gaining over 23% in the past seven days, a sign of sustained investor demand and increasing market confidence.

Aster’s rally builds on a breakout from the $1.75 consolidation zone last week. The token is now pushing toward the key $2.00 psychological resistance, a level that has previously triggered strong price reactions.

The rising volume and strong daily candles signal active buying interest. A clean move above this mark could open room toward the $2.10–$2.20 range, last seen earlier in the month. On the downside, short-term support lies at $1.90, while stronger buy interest may re-emerge around $1.85, the lower edge of its recent uptrend channel.

Aster token gains as platform overtakes rivals in fees

While the token’s price is attracting attention, Aster is also making waves in the DeFi sector. According to DefiLlama, Aster has emerged as the top fee-generating protocol across all chains, raking in $29.16 million in the past 24 hours.

This puts it well ahead of its rival Hyperliquid, which generated a more modest $3.17 million during the same period.

On the weekly chart, Aster has also maintained a clear lead, with $93.5 million in fees generated. This surpasses Tether and Circle, two of the largest stablecoin issuers, which recorded $154 million and $54 million, respectively. Their daily fees also lag behind the exchange by a wide margin, with Tether at $22.2 million and Circle at approximately $7.7 million.

This adds to Aster’s dominance in perpetual trading volume. It reflects deep user engagement, sustained trading volumes, and its growing relevance in the decentralized derivatives space. However, whether the protocol can sustain this dominance remains to be seen.

With the Aster token now approaching key resistance levels and the broader crypto market showing signs of recovery, the next few days will reveal whether it can continue its current upward movement.